direct deposit owner's draw quickbooks

This employee box and enter the following information. ACH is a useful payment method.

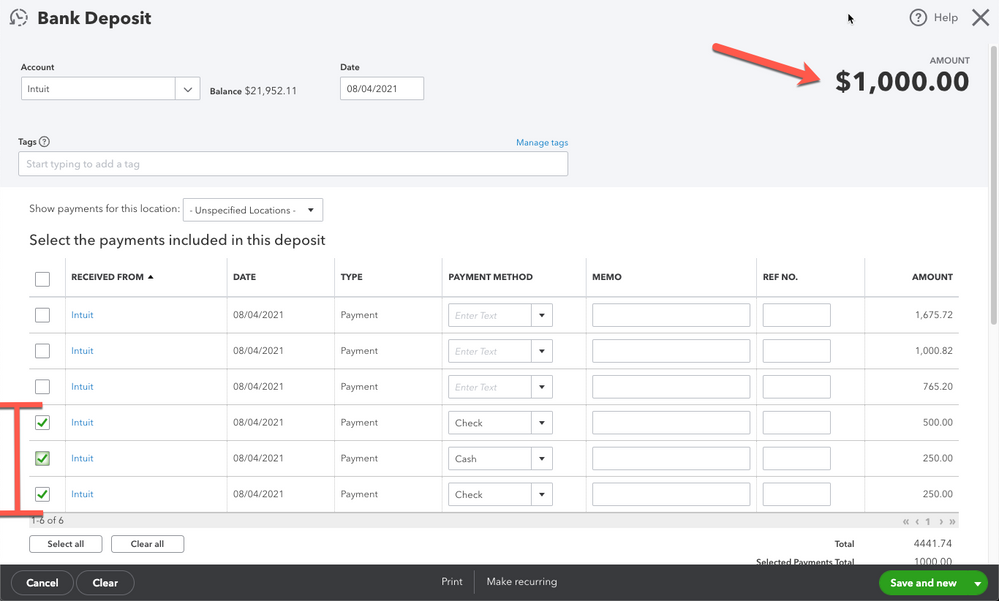

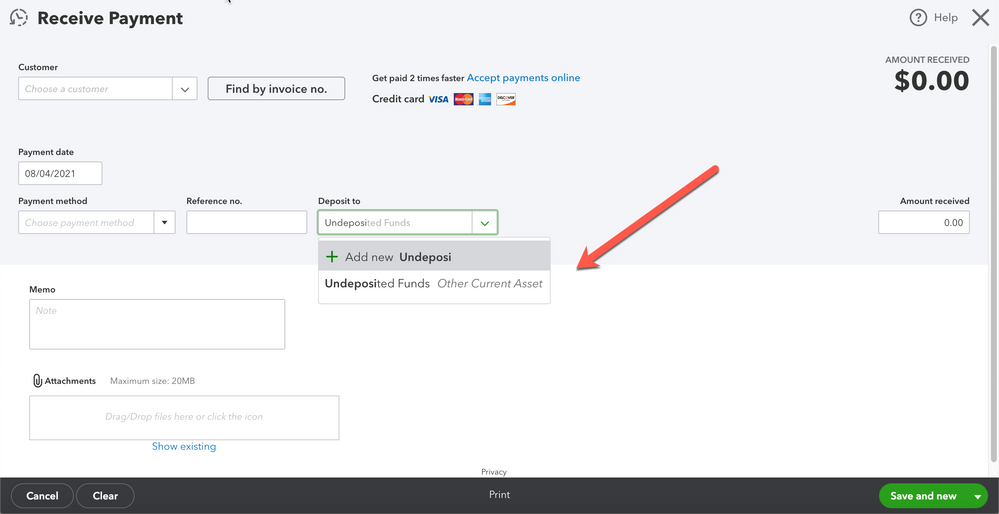

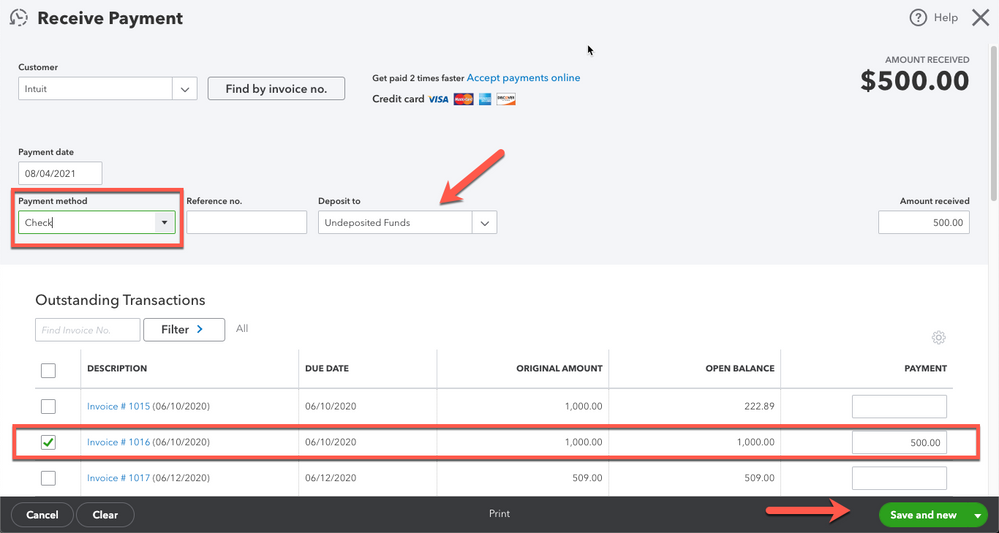

Using Undeposited Funds In Quickbooks Online

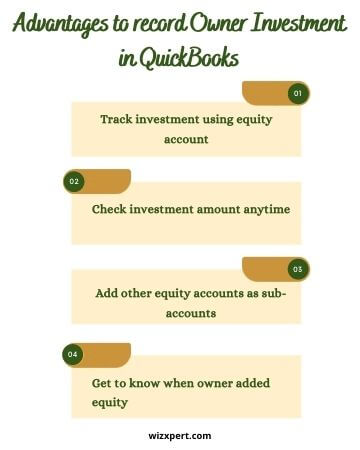

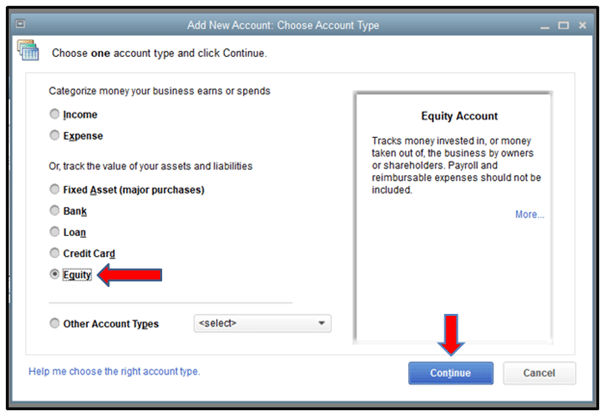

Open the chart of accounts and choose add.

. An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner. To write a check from an. Register For Direct Deposit.

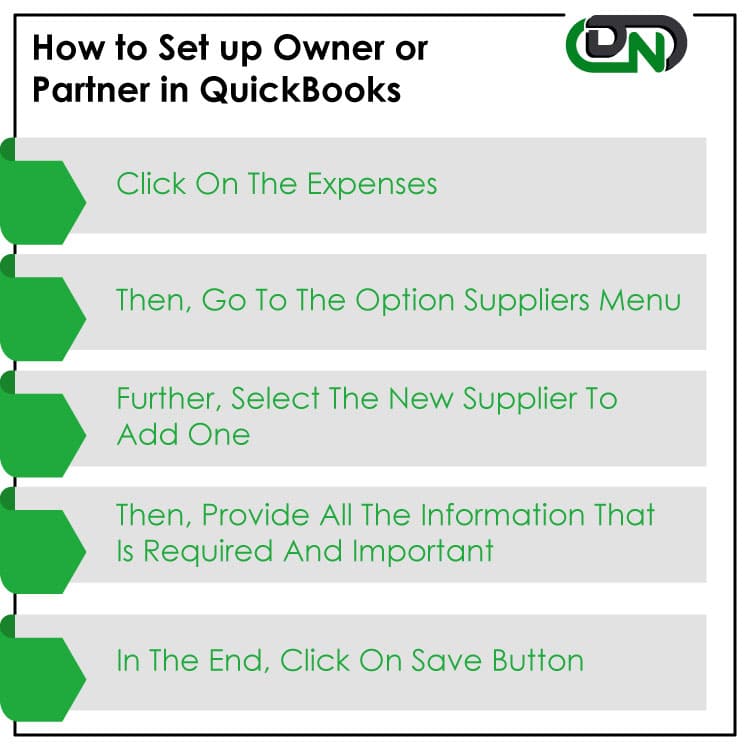

Click the Use Direct Deposit for. If you already have employees information in QuickBooks Online you can simply select each employee and click Set Up to enroll them in. When making a direct deposit payment to an owner youll need to set up an owner or partner as a vendor as suggested by my colleagues above.

One processed this morning around 11am-12pm. Setting Up an Owners Draw. Visit the Lists option from the main menu.

By Posted on August 18 2022. I got the email that my work sent me the payment but the first. Go to the Employees tab.

How do i. Follow these steps to set up and. Select Use Direct Deposit for checkbox and then select whether to deposit the paycheck into one or two accounts.

If you do your own books you can record it on your. Direct Deposit Owners Draw Quickbooks. You can also choose whether to.

For tax purposes it often helps to know how much the owner has taken in draws for the current. Before you can record an owners draw youll first need to set one up in your Quickbooks account. Go to the Employees menu select My Payroll Services by then Activate Direct Deposit.

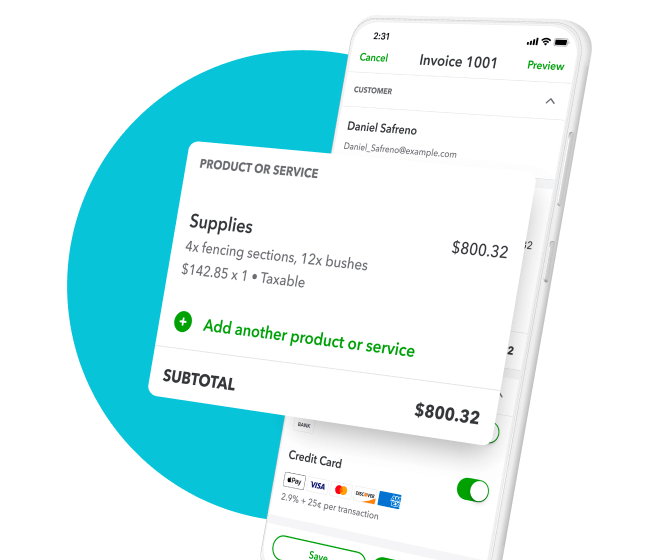

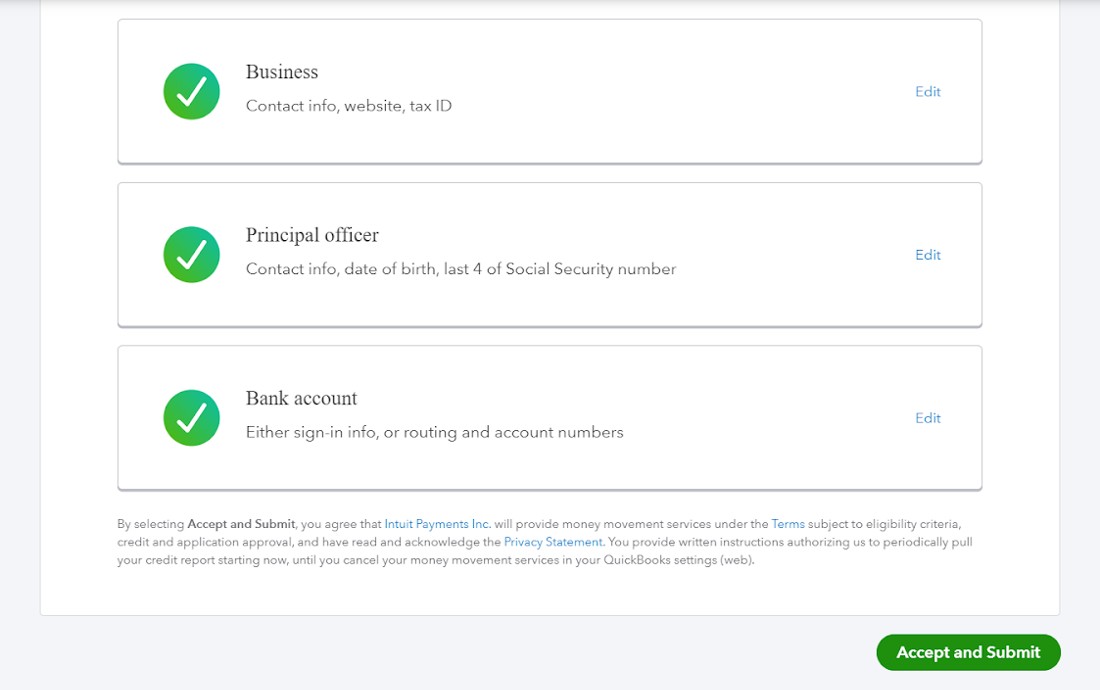

If you have been. QuickBooks charges a transaction processing fee when you accept ACH payments from customers through QuickBooks Payments. Complete and review the structure.

I have two incoming direct deposits. Bank name account number account type and routing number. Step 1 Locate the image on the right and select the PDF button below it.

Enter the employees financial institution information and then click OK to. Add a new equity account and title it owners draws. Question about direct deposit.

Direct Deposit Owners Draw Quickbooks. Create a Prior year draws account at the beginning of the next year. This will enable you to download the IntuitQuickbooks Payroll Direct Deposit Form as a PDF.

Ad Make ACH Files From QuickBooks For Direct Deposit Collections More.

Setup And Pay Owner S Draw In Quickbooks Online Desktop

Using Undeposited Funds In Quickbooks Online

How To Record Owner Investment In Quickbooks Set Up Equity Account

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

Set Up Quickbooks Online Payroll Youtube

How Can I Pay Owner Distributions Electronically

How To Create Employee Profiles In Quickbooks Desktop Youtube

Quickbooks Training Purchase Order For Inventory And Receive Inventory Quickbooks Quickbooks Training Consulting Business

Getting Started In Quickbooks Online Payroll Quickbooks Training Webinars Youtube

Quickbooks Training Purchase Order For Inventory And Receive Inventory Quickbooks Quickbooks Training Consulting Business

Learn How To Record Owner Investment In Quickbooks Easily

Accounts Receivable Software Quickbooks

How To Record Owner Investment In Quickbooks Set Up Equity Account

How To Set Up Pay Payroll Tax Payments In Quickbooks

Using Undeposited Funds In Quickbooks Online

How Can I Pay Owner Distributions Electronically

How To Run Payroll And Set Up Direct Deposit In Quickbooks Online Payroll Youtube