tax loss harvesting canada

Tax loss harvesting is a new term that might sound strange to ordinary people in Canada. Explore Tax Swaps that Can Help You Lower Costs and Target New Markets with SPDR ETFs.

![]()

2022 Crypto Tax Loss Harvesting Guide Cointracker

How Tax-Loss Harvesting Works.

. Ad Down Markets Offer Big Opportunities. At the most basic level tax-loss harvesting involves selling a poorly-performing investment and reinvesting that money into another. Tax gainloss harvesting is a strategy of selling securities at a loss to offset a capital gains tax liability.

Last Updated July 20 2022 544 pm EDT. Nevertheless its simple and straightforward if you understand a few guidelines. Why tax-loss harvesting is different this year This is the first year in a long time where fixed income assets are delivering negative returns.

According to a study from researchers at MIT between 1926 and 2018 tax-loss harvesting added a little under 1 percent to your returns on average. Tax-loss harvesting or tax-loss selling is a tax strategy by which you intentionally sell an investment for a loss in order to offset capital. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Its a strategy that applies only to taxable investment. Any DIY investor with a discount brokerage account can do their own tax loss harvesting however keeping track of everything on your own can be tough. First you need to estimate your current capital gains for the year and.

Tax loss harvesting also known as tax loss selling is the practice of selling shares or units held in a non-registered account that have dropped in value to the point that a capital loss can be. However its most valuable to help you achieve tax efficiency in your portfolio over time as the markets. Tax-loss selling or tax-loss harvesting occurs when you deliberately sell a security at a loss in order to offset capital gains in Canada.

Tax-loss harvesting occurs when you sell an investment that has dropped below its original purchase price triggering a capital loss. It offers a tremendous amount of. Connect With a Fidelity Advisor Today.

Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins. Learn How to Harvest Losses to Help Reduce Taxes. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Tax-Loss Selling Made Crystal Clear. A capital loss can be used to offset a capital gain within a non-registered account. It is typically used to limit the recognition of short-term capital gains.

Tax-loss selling also known as tax-loss harvesting is a strategy available to investors who have investments that are trading below their original cost in non-registered. Tax loss harvesting is sometimes thought of as an annual or year-end technique. However in general you can expect to save around 30 of the.

Tax loss harvesting is a method of reducing your taxes on capital gains realized from the sale of certain investments. You can then use these losses to. Tax loss harvesting consists of three steps.

One consideration for investors when employing tax-loss harvesting is the superficial loss rule. These gains arose due to. How to tax loss harvest.

This maneuver is known as tax-loss harvesting or tax loss selling. Connect With a Fidelity Advisor Today. As an example suppose you invest 100000 in a Canadian equity ETF and then the value declines to 90000.

Canadian aggregate bonds for. By selling your shares you. The funds are then used to purchase a comparable.

This rule states that if an investor buys back the same security within 30 days of sale the tax. The amount of money that you can save with tax loss harvesting in Canada depends on your tax bracket.

Using Market Volatility To Reduce Taxes A Case Study In Tax Loss Harvesting O Shaughnessy Asset Management

How To Use Tax Loss Harvesting To Boost Your Portfolio

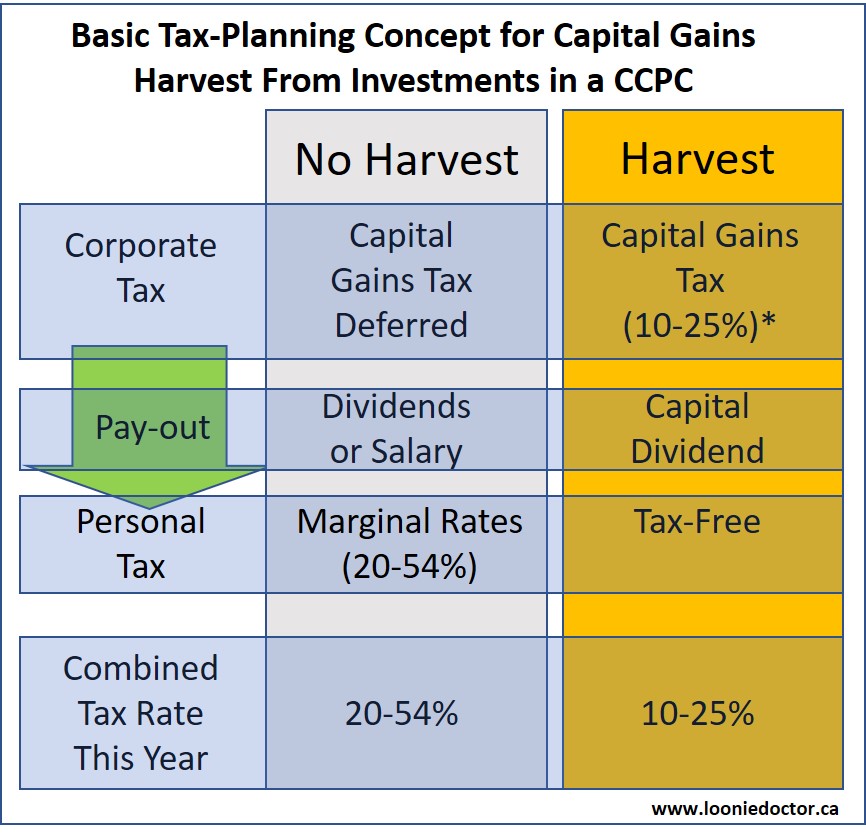

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

What Is Tax Loss Harvesting Ticker Tape

Complete Guide To Canada S Capital Gains Tax Zolo

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

How To Use Tax Loss Harvesting To Boost Your Portfolio

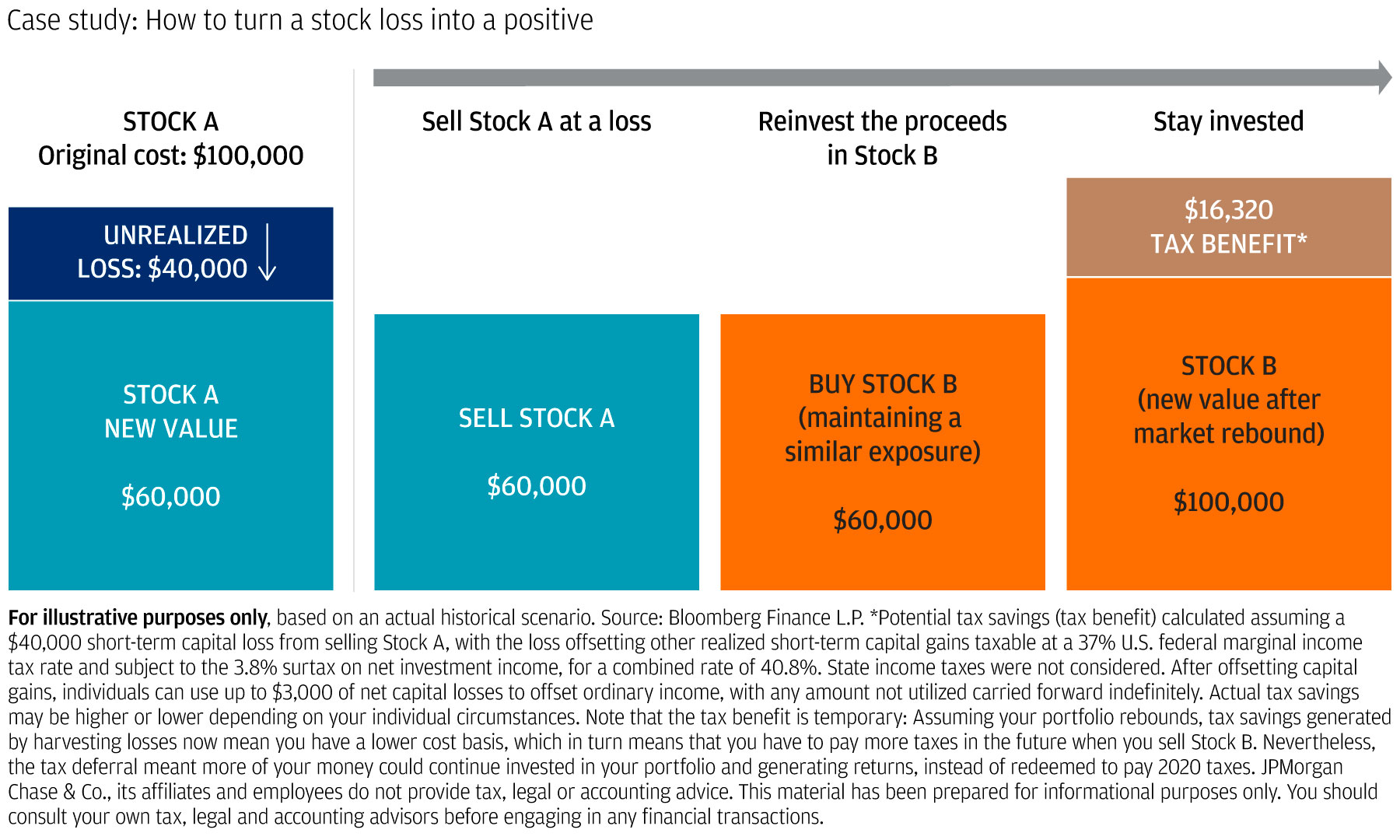

Turning Losses Into Tax Advantages

![]()

2022 Crypto Tax Loss Harvesting Guide Cointracker

How To Boost Portfolio Returns With Tax Loss Harvesting Strategies Bny Mellon Wealth Management

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Turning Losses Into Tax Advantages

Tax Loss Harvesting 2022 John Hancock Investment Mgmt

How Can Today S Market Volatility Be Turned Into Tax Benefits J P Morgan Private Bank

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

Tax Loss Harvesting At Work A Wealthsimple Case Study Boomer Echo